RSI Trading Indicator Indices Trading Strategy

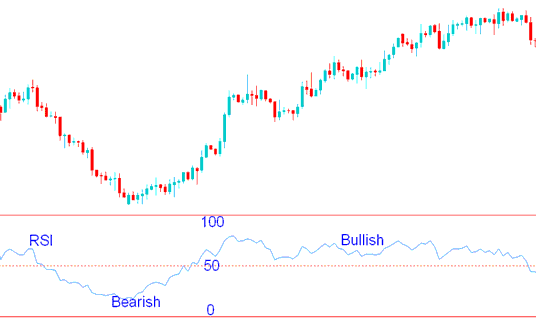

Relative Strength Index or RSI is one of the most popular Indices trading indicator used in Stock Indices trading. It is an oscillator Indices indicator which oscillates between 0 -100. This a trend following Stock Index indicator. It indicates the strength of the Stock Indices trend, values above 50 indicate a bullish Stock Index trend while values below 50 indicate bearish Stock Index trend.

RSI Trading Indicator Measures Momentum of a Stock Indices Trend.

The center-line for the RSI is 50 Index indicator, crossover of the center-line indicate shifts from bullish to bearish Stock Index trend and vice versa.

Above 50, buyers have greater momentum than the sellers and price on the Stock Indices trading chart will keep going up as long as this RSI Stock Index indicator stays above 50.

Below 50, sellers have greater momentum than the buyers and price on the Stock Indices trading chart will keep going downward as long as RSI Stock Index indicator stays below 50.

RSI Trading Indicator - How to Trade Stock Indices with RSI Indicator

In the Stock Indices trading example above, when the Stock Indices indicator is below 50, price kept moving in a downward Stock Indices market trend. The price continues to move down as long as RSI indicator was below 50. When the RSI Stock Index indicator moved above 50 it showed that the momentum had changed from sell to buy & that the downward Stock Indices trend had ended.

When the RSI Stock Index indicator moved to above 50 the price started to move upwards and the Stock Indices trend changed from bearish to bullish. The Stock Indices trading chart price continued to move upwards and the RSI indicator remained above 50 afterwards.

From the Stock Indices trading example above, when the Stock Indices trend was bullish sometimes the RSI would turn downwards but it would not go below 50, this shows that these temporary moves are just retracements because during all these time the Stock Indices price trend was generally upward. As long as RSI indicator does not move to below 50 the current Stock Index trend remains intact. This is the reason the 50 center line mark is used to demarcate the signal between bullish & bearish Stock Index signals.

The RSI Stock Index indicator uses 14 day period as the default period, this is the period recommended by J Welles Wilders when he introduced it. Other common periods used by traders are the 9 & 25 day moving average.

The RSI indicator period used depends on the Stock Indices trading chart time frame you're using to trade, if you are using day Stock Index trading chart time frame the 14 period will represent 14 days, while if you use 1 hour Indices trading chart time frame the 14 period will represent 14 hours. For our Indices example we shall use 14 day moving average, but for your trading you can substitute the day period with the chart time frame you're Stock Indices trading with.

To Calculate RSI Indicator:

- The number of days that a Stock Indices market is up is compared to the number of days that the Stock Indices market is down in a given time period.

- The numerator in the basic formula is an average of all the Stock Indices trading sessions that finished with an upward price change.

- The denominator is an average of all the down Stock Indices sessions closes for that period.

- The average for the down days are calculated as absolute numbers.

- The Initial RSI is then turned into an oscillator.

Sometimes very large up or down movement in price in a single Stock Indices session price period may skew the calculation of the RSI average and produce a false Stock Indices trading signal - whipsaw signal - in the form of a spike.

RSI Center-line: The center-line for this Stock Indices indicator is 50. A value above 50 implies that the Stock Indices market trend is in a bullish phase as average gains are greater than average losses. Values below 50 indicate a bearish phase in the Stock Indices market prices are generally closing lower than where they opened.

Overbought & Oversold Levels: Wilder set the RSI overbought & oversold levels at which the Stock Indices market moves are overextended at 70 & 30.