How to Trade Downwards Indices Trend Line Reversal Indices Trading Signals Combined with Double Bottom Reversal Stock Indices Chart Patterns Indices Trading Setups

Downwards Indices Trend Reversal Signals and Double Bottoms Reversal Stock Indices Chart Patterns Strategy

Down Indices trend Stock Indices Trading Reversal

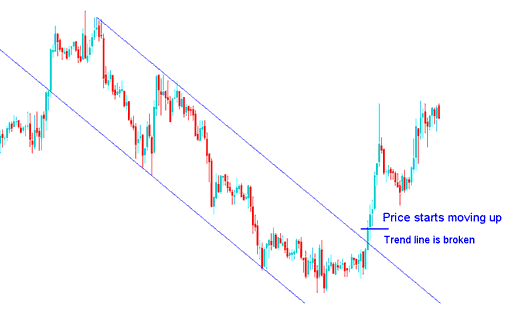

When stock indices price breaks downward indices trend line (resistance) the stock indices trading market will then move up

Downwards Indices Trend Line - Indices Trend Reversal Trading Signal

This signal is considered to be complete with the formation of a higher low or higher high. This reversal indices trendline break can also be combined with the double bottom reversal stock indices chart patterns as described on the stock indices trading examples explained below:

Combining Downwards Indices Trend Reversal Signals with Double Bottoms Reversal Chart Patterns

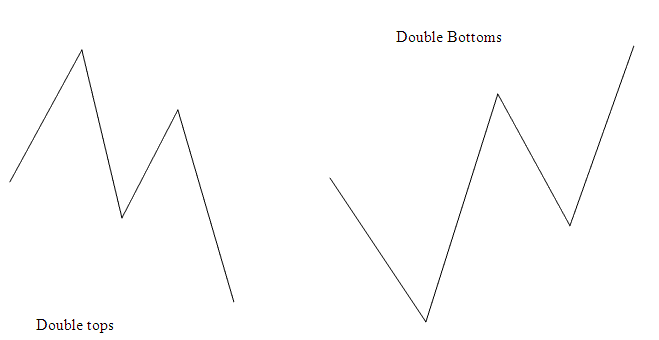

A good indices trading reversal trade setup to combine indices trendline break reversal strategy with is the double bottom stock indices patterns - Double Bottom Reversal Chart patterns Guide.

Double bottom reversal stock indices chart patterns setup should already have formed before the down indices trend break indices trading reversal signal. Because the double bottom are also reversal stock indices trading signals, then combining these 2 reversal trading strategies will give the trader a good probability of avoiding a indices trading whipsaw.

In the above stock indices chart example these double bottoms setups can be confirmed to have formed even before the trend line reversal stock indices signal appeared.

Example of Downwards Direction Reversal - the Double bottoms reversal stock indices trading pattern had already formed before down indices trendline break reversal signal appeared on stock indices chart.

Combining Downwards Indices Trend Reversal Signals with Double Bottoms Reversal Chart Patterns