Stock Indices Price Action Trading System in Indices Trading

Indices Price action indices trading is the use of only stock indices price charts to trade Indices, without the use of technical chart technical indicators. When trading with this stock indices price action strategy, candlestick stock indices charts are used.

Stock Indices Price Action Trading System in Indices Trading

The best use of this stock indices price action strategy is achieved when the stock indices price action trading signals generated are combined with other indicators so as to provide extra confirmation. This is then used a stock indices trading system.

The indices trading system includes stock indices price action trading together with indices indicators trading so as to create a indices trading system or a indices trading strategy based on these two methods of stock indices technical analysis.

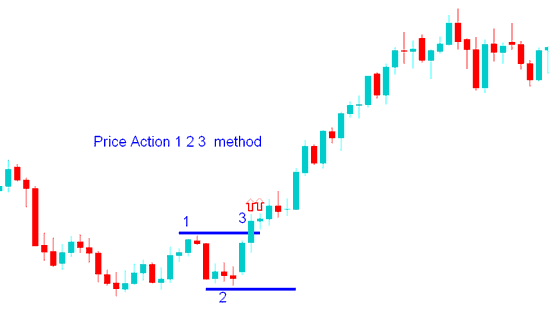

Stock Indices Price Action 1-2-3 Breakout Strategy

This stock indices price action trading strategy uses three chart points to determine the break out direction of indices. The 1-2-3 stock indices price action strategy uses a peak and a trough, these points forms point 1 and point 2, if market moves above the peak the trading signal is long, if it moves below the trough the signal is to short. The break out of point 1 or point 2 forms the third point.

Indices Price Action Trading System in Indices Trading - Indices Price Action Trading System Example

As with any other indices trading strategy this stock indices price action trading strategy should also be combined with other indices technical indicators to confirm the stock indices price action signals and avoid whipsaws. The 1-2-3 stock indices price action trading pattern can give good indices trading signals in a trending market but will give whipsaws when the stock indices trading market is ranging, it is best to determine if the stock indices trading market is trending or not before you start using this stock indices price action strategy.

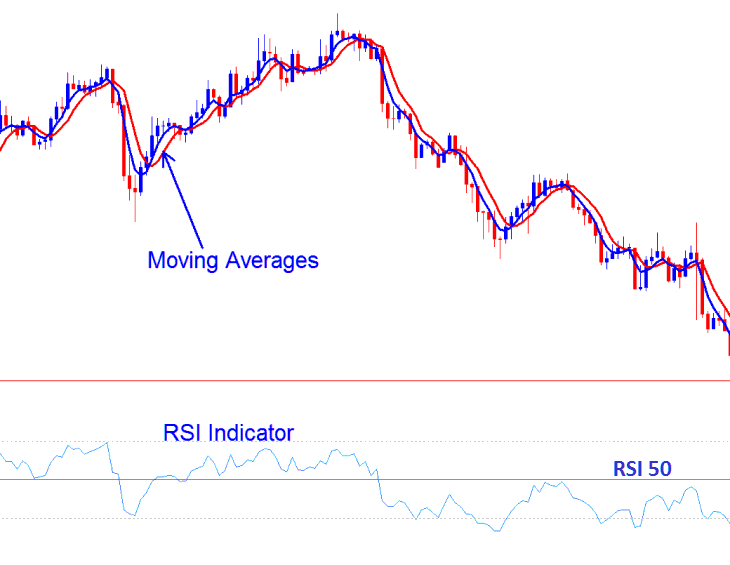

RSI and Moving Averages to Create Indices Price Action Trading System in Fore

Good indices indicators to combine stock indices price action trading with are:

- RSI

- Moving Average Indicator

Stock indices traders should use these two indices technical indicators to confirm if the direction of breakout stock indices price action signal is in line with the indices trend direction shown by these two stock indices chart indicators.

If the direction is also the same as those of these indicators then stock indices traders can open a trade in direction of the stock indices price action signal.

If not stock indices traders should not open a trade as there is more likely a chance that this stock indices price action signal may be a indices trading whipsaw.

Just like any other chart indicator in Indices Trading, stock indices price action also has whipsaws and there is a requirement to use this stock indices price action strategy with other indicators as a combination with other signals from these indicators as opposed to just using this stock indices price action strategy alone.

Indices Price Action Indices Strategy - Indices Price Action Trading System Example