Islamic Swap Free Account

In Indices, there's the payment of swaps every day: this is the interest rate of a indices that indices earns per day. This interest for indices like the Australian Dollar is 5%, this means that every day a fraction of this five percent is paid to anyone holding this Australian Dollar.

This brings the Issue of paying & getting paid of an interest payment which is an Issue in the Islamic Religion. Islamic Religion does not allow paying and getting paid of interest, for Islamic indices traders there is a trading account designed in accordance with their Values: Referred to as Swap Free.

For this indices trading account a trader will not pay the overnight rollover interest on any indices trade and will also net get paid any interest, this is also known Shariah Compliant where there is no paying of RIBA (interest) - also referred to as Islamic Accounts.

For a trader to get a swap free account, a trader has to go to a indices trading Islamic stock indices trading broker & choose option of 'Islamic Account', This option is provided under the Accounts Section of the broker specifying the instructions of opening one of these accounts.

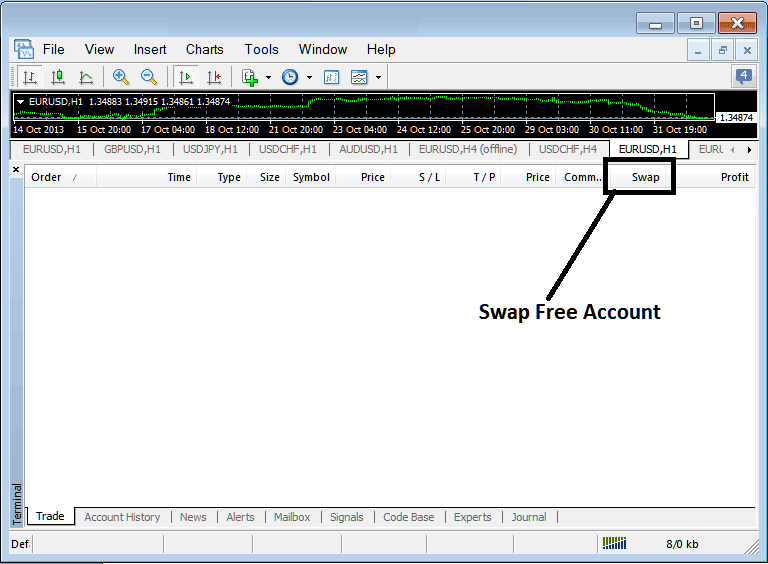

Once a trader opens a this stock indices trading account, then the Indices rollover interest is removed. Once this no paying of interests is set, if a trader is using a platform such as MetaTrader 4 then the rollover fee record will be set to zero.

Rollover fee is charged daily at the end of the trading day for those holding indices for which a swap is to be applied. As a trader if you do not want to pay this rollover you should close your trades before the end of the day, that way you will not pay the rollover fee as you are no longer holding open indices trade. Because the stock indices trading market does not open on Saturday and Sunday, rollover for these 2 day will be charged on Wednesdays, meaning on Wednesday one will pay the rollover for Wednesday, Saturday and Sunday, & therefore on Wednesdays this rollover fee is paid 3 Times.

These positions that pay a rollover interest are commonly referred to by traders as Overnight Trade Positions. Day Traders rarely leave their trades opened overnight and close them all before the end of the day. Swing Traders on the other hand may leave their trades opened for a few days and leave these trades overnight so that to capture more movement in the stock indices price trend.

Once a trader finds a swap free stock indices trading broker and opens and Islamic Account, the trader will have the same trading conditions as those of other traders, except for the paying of rollover fees. This means a trader will use the MetaTrader 4 Indices Trading Software like all the other traders, the trader can trade all currencies, all indices, all CFDs, all metals and all other Financial Instruments provided by the indices trading Islamic broker.

However, be careful in choosing a swap free broker, some brokers will add a commission or add some pips to the spread you trade with to cover the swap(Swap Fee Broker). This is not supposed to happen as a trader will still be paying for the interest even though is disguised as another charge, good indices trading Brokers do not add any commission nor do they add any charge on to the spread.

Another thing is that some brokers will charge a rollover fee (swap fee) if the position held by a trader is held for more than 5 days or more than 7 days, this should not be the case & the broker should not charge any carry-over interest even if the open trade positions are held for more than five or seven days. For traders wanting to open this swapfree trading account with a indices trading Islamic indices broker it is good to check for any additional terms of trading for the Islamic Account that you are going to be opening to make sure that the broker you choose is really a no swap broker.

Islamic Indices Trading Account

Swap free accounts were introduced by trading brokers after demand for carry-over interest free accounts grew among Islamic indices traders. The traditional account entailed paying of rollover interests in what is known as rollover interest. This led to the introduction of Interest Free Accounts that Islamic traders could open and still keep in line with their rules on no paying and getting paid interest.