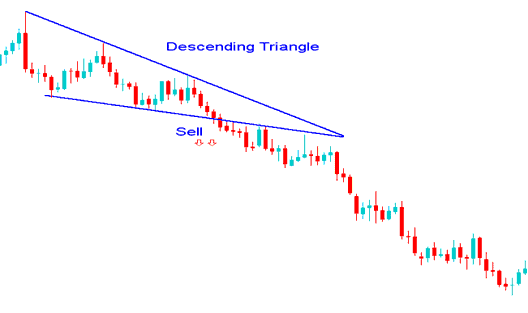

Indices Price Breakout after Descending Triangle Pattern

Descending Triangle Stock Indices Chart Pattern

The descending triangle stock chart pattern in indices trading is formed in a downward trend and it shows that the downwards direction of stock indices price movement is going to continue.

Descending triangle stock indices chart pattern is a continuation stock indices chart pattern that signals the current downwards stock indices market trend is going to continue.

Descending triangle stock indices pattern is also known as falling wedge stock indices trading chart pattern.

Descending triangle stock indices chart pattern shows that there is a support level that the sellers keep pushing each time moving this support level lower, and once it breaks stock indices price will continue to move downwards.

A downside penetration of the lower line of the descending triangle stock indices chart pattern is a technical sell stock index signal for a market breaking downwards from a descending triangle, & this indicates selling will follow.

Indices Price Breakout after Descending Triangle Pattern

The stock indices market formed a descending triangle stock indices pattern during its downwards indices trend which led to further selling & continuation of the indices downward market trend.

The technical sell stock indices signal is when stock indices price breaks out the lower horizontal sloping line of the descending triangle pattern and selling resumes to push the stock indices trading market stock indices price lower - continuation of the downwards indices trend.