MACD Trend Following Strategy PDF

MACD and Moving Average Strategy

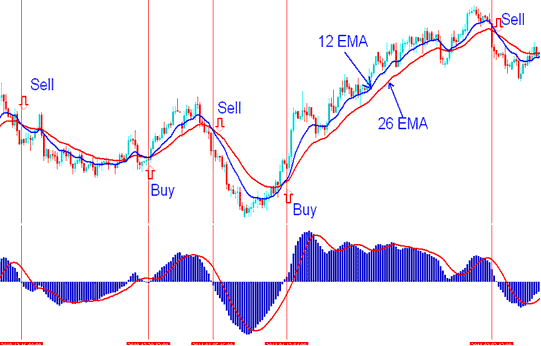

Since the MACD indicator uses 26 and 12 EMA to draw the MACD indicator lines, we shall compare these two EMAs with the MACD indices trend following indicator to determine how these buy and sell signals are generated and how the MACD indicator can be used to generate trend following signals.

MACD Stock Indices Indicator - MACD Trend Following Strategies - MACD Indices Indicator Strategy - MACD and Moving Average Strategy

The MACD indicator is a trend following indicator meaning it generates indices trading signals that are leading compared to lagging indicators that lag behind the indices price.

Buy Stock Indices Trade

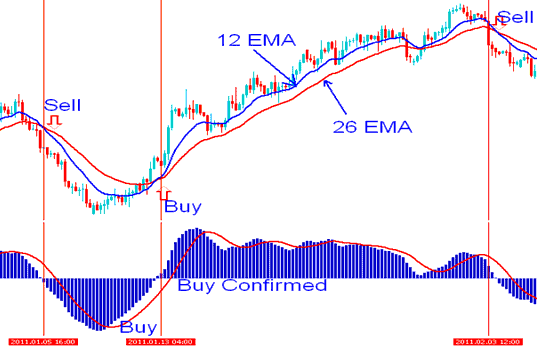

A buy indices trade is generated when there's a MACD fast line crosses above the signal line - this shows that there is an upward stock indices trend. However, as with any leading indices indicator these stock indices signals are prone to whipsaws/fake-out trading signals.

To eliminate the indices whipsaws it is good to wait for confirmation signals of the buy signals. The confirmation indices signal is when the two MACD indicator lines cross above the zero line mark, when this happens the buy stock indices signal generated is a reliable indices trade signal.

In the stock indices trading example explained and illustrated below, the Moving average stock indices indicator generated a buy signal, before the stock indices price started to move up. But it wasn 't until the MACD indicator moved above the zero line that the buy signal was confirmed, and the Moving Averages also gave an upward crossover indices signal. From experience it's always good to buy after both the MACD indicator lines move above zero center line mark - which shows there is an upward stock indices trend.

Where to Buy using MACD Stock Indices Indicator - MACD and Moving Average Strategy

Sell Indices Trade

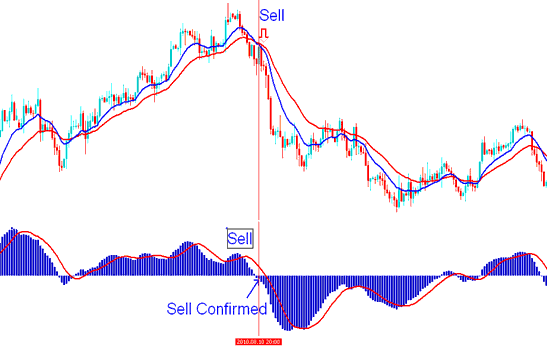

A sell stock indices signal is generated when there is a MACD fast line crosses below the signal line. However, just like the buy signal, these are also prone to whipsaws/ fake outs.

To eliminate the whipsaws it is good to wait for confirmation of the sell signal. The confirmation is when two lines cross below zero mark, when this happens the sell generated is a reliable indices trade signal.

In the stock indices trading example explained and illustrated below, the Moving average generated a sell confirmed after MACD moved below the zero line at the same time that the Moving Averages gave a crossover indices trade signal.

Where to Sell - MACD & Moving Average Indices Strategy - Using MACD Stock Indices Indicator - Sell Trading Signal