RSI Indices Strategies & Relative Strength Trading Signals

The RSI technical indicator was developed by J. Welles Wilder.

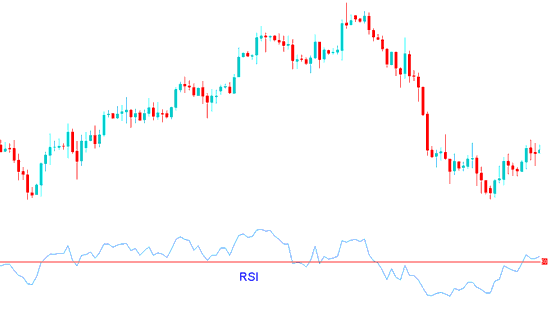

The RSI indicator is a very popular oscillator and useful momentum oscillator indicator. The RSI technical indices indicator compares stock indices price movement magnitude of recent gains against its magnitude of recent losses and calculates this information into a value that ranges between 0 and 100.

Indices Strategies & RSI Indices Technical Analysis

There are several technical analysis techniques of interpreting RSI indicator - these are:

RSI Divergence Indices Trading:

Analyzing indices divergence between the RSI indicator & stock indices price can help indices traders in identifying potential indices trend reversal points. Open buy indices trade when there is RSI Classic Bullish Indices Divergence: Lower lows in stock indices price and higher lows in the RSI technical indictor; Open sell indices trade when there is RSI Classic Bearish Indices Divergence: Higher highs in stock indices price and lower highs in the RSI technical indicator. These types of RSI indices divergence signals are often indicators of a indices trend reversal.

RSI Overbought & Oversold Levels: RSI 80 & RSI 20 Indices Trading Strategy or RSI 70-30 Strategy

The RSI technical indicator can be used to identify overbought and oversold levels in stock indices price movements. RSI overbought levels - RSI being greater than or equal to the 70% level while RSI oversold levels - RSI being less than or equal to the 30% level - Some traders will also use the overbought and oversold levels as 80% and 20% for the RSI technical indicator. Indices trades can be generated when the RSI indicator crosses these overbought and oversold levels. When the RSI technical indicator crosses above 30 level a buy stock indices signal is given. Alternatively, when the RSI technical indicator crosses below 70 level a sell stock indices trade signal is given.

RSI 50 level Crossover Indices Signal: RSI Crossover Indices Signals

When the RSI indicator crosses above 50 center mark a buy signal is given. Alternatively, when the RSI indicator crosses below 50 center mark a sell indices trade signal is given.

RSI Indices Trading Strategy PDF - The Encyclopedia of RSI PDF - RSI Indices Trade Strategies Guide

RSI Strategy Guide

- RSI Overbought and Oversold Levels

- RSI Divergence Indices Trading Setups

- RSI Classic Bullish & RSI Bearish Divergence Indices Trading

- RSI Hidden Bullish & RSI Bearish Divergence Indices Trading

- RSI Swing Failure Strategy

- RSI Stock Indices Chart Patterns RSI Trend Lines

- RSI Indices Trading Summary

RSI Trading Strategy PDF - The Encyclopedia of the Indicator RSI - Best RSI Trading Strategy - Advanced RSI Strategy PDF