Indices Price Action Breakout Scanner MetaTrader 4

Intraday Breakout Trading Strategy Indices

Indices Price Action Indices Breakout Pattern is the use of only stock indices price pattern to trade indices - without the use of indices indicators. When trading with this stock indices price action indices breakout pattern -indices candles trading charts are used. This stock indices price action indices breakout trading strategy uses lines and pre determined stock indices price patterns such as the 1-2-3 stock indices price action indices breakout pattern that either develops or series of indices candlesticks bars.

Traders use this stock indices price action indices breakout pattern strategy because this technical analysis is very objective and allows stock indices traders to analyze the stock indices market price moves based on what they see on stock indices price charts alone.

This stock indices price action indices breakout pattern strategy is used by many traders: even those that use indices indicators also integrate some form of stock indices price action analysis in their indices trading strategy.

The best use of this stock indices price action indices breakout method is achieved when the stock indices signals generated are combined with line studies so as to provide extra stock indices signal confirmation. These line studies include indices trend lines, Fibonacci retracement levels, support and resistance areas.

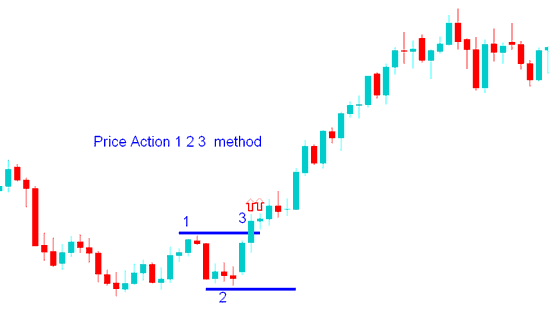

Indices Price Action Trading Breakout Technical Analysis Pattern 1-2-3 Stock Indices Breakout Strategy

This stock indices price action indices breakout pattern 1-2-3 method trading strategy uses three chart points to determine the stock indices price break out direction of the indices price. The stock indices price action indices breakout pattern 1-2-3 indices trading method uses a peak and a trough, these chart points form point 1 and point 2, if stock indices price moves above the peak, the indices signal is - buy signal, if stock indices price moves below the trough, the indices signal is - sell signal. The stock indices price break out of point 1 or point 2 forms the third point of the stock indices price action indices breakout pattern 1-2-3 method.

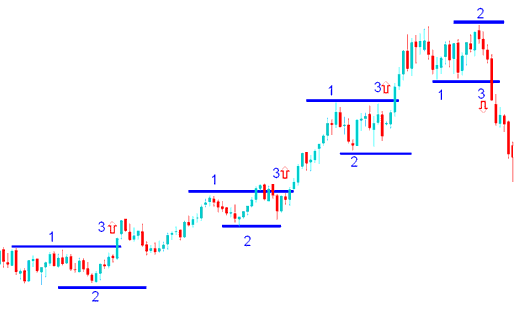

Indices Price Action Stock Indices Breakout Screener - Trading Indices Price Action Stock Indices Breakout Pattern 1-2-3 Stock Indices Breakout Strategy

Series of breakouts in stock indices price action indices breakout pattern 1-2-3 stock indices price action indices trading strategy

Indices Price Action Trading Break Out Technical Analysis

Traders use stock indices price action indices breakout strategy to try and predict where a indices price direction might move next. The indices market is either trending or ranging.

A indices trending market moves in a specific direction while a ranging indices market moves sideways, normally after stock indices price hits a support or resistance level.

Analyzing the movement of stock indices price action provides information of whether the indices market is trending or ranging or reversing its indices trend direction.

As with any other indices strategy this stock indices price action indices breakout pattern strategy should also be combined with other confirmation indices indicators to avoid indices whipsaws. The stock indices price action indices breakout pattern 1-2-3 stock indices price action pattern can give good indices trading signals in a trending indices market but will give whipsaws when the indices market is ranging and moving sideways, it is best to determine if the indices market is trending or not before you start using this stock indices price action indices breakout pattern indices trading strategy.

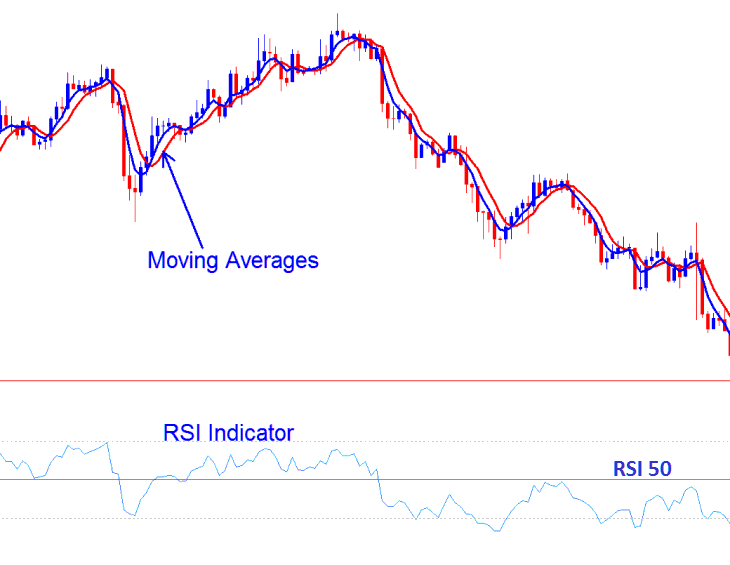

RSI and Moving Averages

Good indices indicators to combine stock indices price action trading method with are:

- RSI Indicator

- Moving Average Indicator

Investors and indices indicators should use these two indices indicators to confirm if the direction of stock indices price action breakout is in line with the indices trend direction shown by these two indices technical indicators. If the direction of the Indices Price Action Indices Breakout Pattern is also the same as that of these indicators then stock indices traders can open a indices trade in direction of the stock indices price action trading signal. If not stock indices traders should not open stock indices trades as there is a likely chance that this Indices Price Action Indices Breakout Pattern signal may be a indices trading whipsaw.

Just like any other indices indicator in indices trading, Indices Price Action Indices Breakout Pattern also has whipsaws and there a requirement to use this stock indices price action stock indices signal as a combination with indices signals from other indices indicators as opposed to just using this stock indices price action indices trading strategy alone.

Indices Price Action Breakout Scanner - Indices Price Action Indices Breakout Screener