OBV Breakout Strategy Indicator

OBV Breakout Strategy is based on the popular stocks indices trading strategy, where stock investors use volumes to predict stock indices price direction, based on the concept "Volumes always precede indices price", in indices market, there is no central clearing house where indices volumes are aggregated, so in trading indices traders use a indices indicator that will estimate the volumes. This indices indicator is known as OBV - On Balance Volume.

Volume Precedes Indices Price

Volumes always precede indices price, this makes volumes a leading indices indicator. Knowing how to interpret this volumes indicator helps indices traders make better decisions when it comes to predicting where the stock indices trading market will be moving to next - volume indicators can be used by stock indices traders to come up with a indices breakout trading strategy.

When volume rises this shows that money is starting to flow into a indices. Because volumes will always precede the indices price, the next thing is that the stock indices price will then go up - Stock Indices Breakout Strategy Indicator. When the OBV indicator is going up it shows there are more buyers than sellers.

When the indices volume falls it shows that money is starting to flow out of a indices. Because volumes will precede the indices price, the next thing is that stock indices price will then go down. When the OBV indices indicator is going down it shows more trading volume is selling than buying.

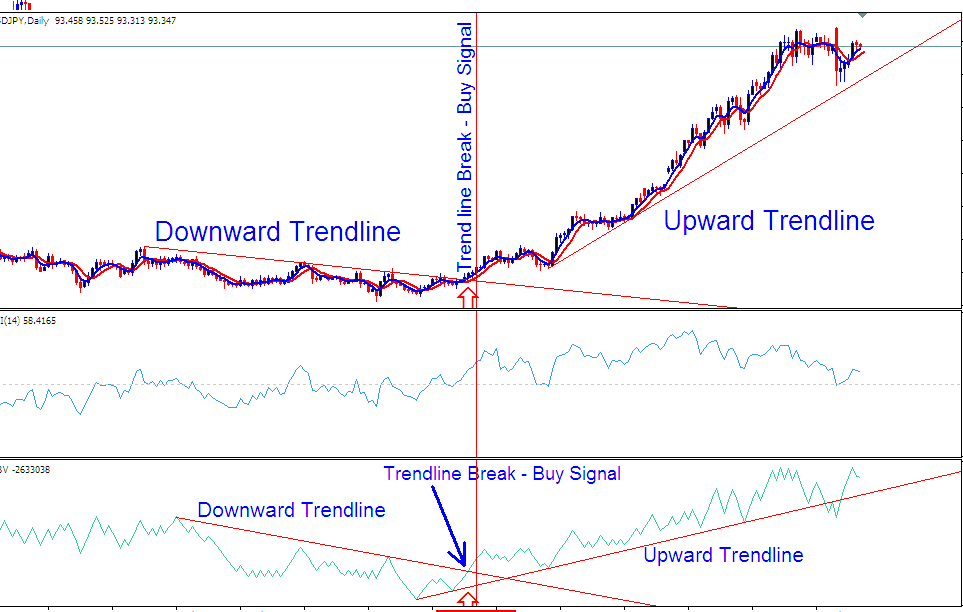

Subsequently, when a downwards trend line of the OBV indicator is broken it shows that sellers are starting to take profit & close their sell orders.

Likewise, when the upward trend line of the OBV indicator is broken it shows that buyers are starting to close their buy stock indices trades & take their profits.

Because the On Balance Volume indicator will add direction to the indices volume and form a general trend direction, a trader can compare the two - the stock indices price trend direction and the OBV indicator trend direction. The direction of these two should correspond and move in the same direction but when there is a disconnect between these two - the stock indices price and the indicator trend direction - then a trader should pay attention to know when to exit the indices market or when to open a new indices order depending on the indices signal.

On Balance Volume is a indices leading indicator and a trader using this indicator can avoid entering the stock indices trading market when it is too late. OBV Indicator is also a good indices indicator to show when to take a profit early enough before the stock indices trading market trend reverses and takes away all your profit.

Example of this Strategy

Indices Volume Breakout Strategy - On Balance Volume Indicator MT4 - OBV Volume Breakout Indicator MT4