MACD Indices Indicator Crossover Trading Signals

MACD Center line crossovers generate stock indices signals using the center line mark. The sentiment of the stock indices trading market can be confirmed using the MACD center line crossovers. MACD indices trading crossover above the center line mark generates bullish stock indices market sentiment while crossover below the center line generates bearish stock indices market sentiment.

- When the FastLine crosses below the MACD Line (not center mark) it shows stock indices market momentum is slowing - this is not a reversal stock indices signal or a sell signal, wait for the center mark cross-over.

- When the Fast line crosses above the MACD Line (not center mark) it shows the stock indices trading market momentum is slowing - this is not a reversal stock indices signal or a buy signal, wait for the center mark cross-over.

- The Center-Line crossover indices trading signals will be the best trading signals for confirming buy and sell signals.

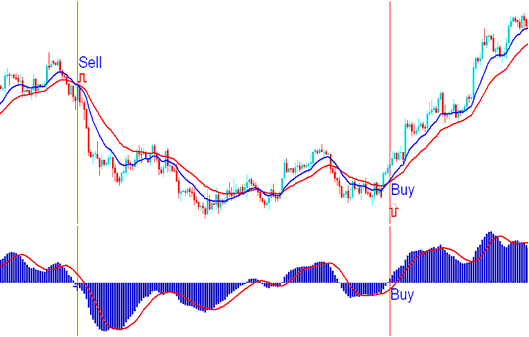

Using the Indices chart in the stock indices trading example explained and illustrated below, when MACD fast line crossed below the zero center mark, the sell stock indices signal was confirmed and the stock indices trading market sentiment changed to bearish - downwards indices trend.

Also in the stock indices trading example explained and illustrated below when MACD fast line later crosses above zero center mark, a buy stock indices signal was generated and the stock indices trading market sentiment changed to bullish - upwards indices trend.

MACD Zero-Line Mark Crossover - Precisely When a Sell Indices Signal and Buy Indices Signal are Generated

Oscillation of the MACD Indicator

The MACD Indices indicator is an oscillator indicator that moves up and down around a zero center line mark. The center-line is the neutral measurement, values above zero will indicate bullish stock indices market indices trend while values below indicate bearish stock indices trend.

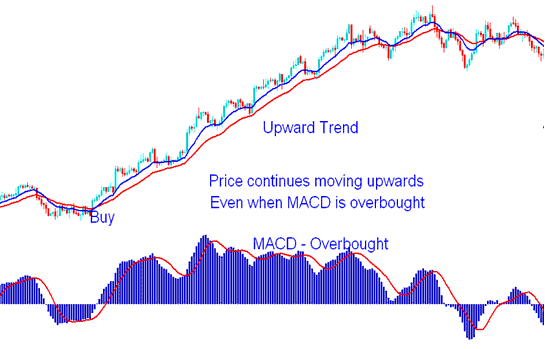

The MACD indicator is also used to indicate overbought and oversold levels. When the MACD reaches overextended levels, then indices is overbought or oversold. However, in a strong upward trending stock indices market indices trading prices will stay overbought in this case it's better to buy.

Also in a strong down indices trending stock indices market its better to sell, because indices trading prices will stay in the oversold region for a long time.

Overbought conditions occur above the zero line while oversold conditions occur way below the zero mark.

MACD Overbought Region - Indices Trend Continuation Signal