Bollinger Bands Indices Trend Reversals

A trader should wait for the stock indices trading price to turn in the opposite direction after touching one of the indices trading Bollinger bands before considering that a indices trading reversal is happening.

Even better a trader should see the stock indices trading price cross over the moving average.

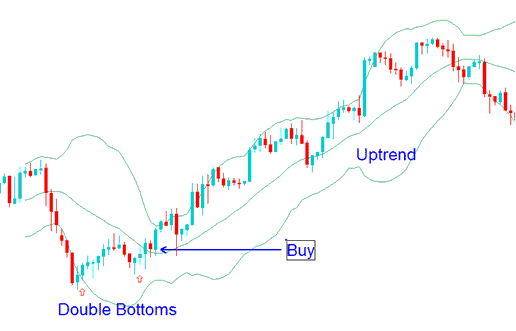

Double Bottoms Indices Trend Reversals

A double bottom is a buy stock indices trading signal set-up. Double top forms when stock indices trading price action penetrates the lower Bollinger band then rebounds forming the first stock indices trading price low, then after a while another stock indices trading price low is formed, and this time it is above the lower Bollinger band.

The second stock indices trading price low must not be lower than the first one and it important is that the second stock indices trading price low does not touch or penetrate the lower Bollinger band. This bullish stock indices trading setup is confirmed when the stock indices trading price action moves and closes above the middle band (simple moving average).

Double Bottoms - Bollinger Bands Indices Trend Reversals Trading Strategy Using Double Bottom Patterns

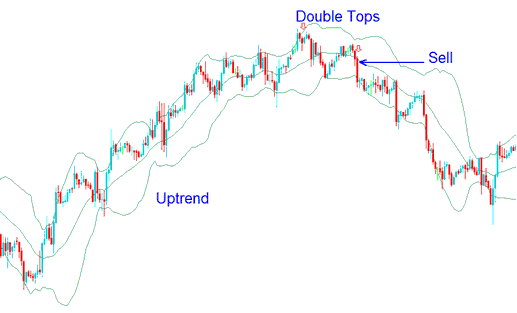

Double Tops Indices Trend Reversals

A double top is a sell stock indices trading signal set-up. Double top forms when stock indices trading price action penetrates the upper Bollinger band then rebounds down forming the first stock indices trading price high., then after a while another stock indices trading price high is formed, and this time it is below the upper Bollinger band.

The second stock indices trading price high must not be higher than the first one and it important is that the second stock indices trading price high does not touch or penetrate the upper Bollinger band. This bearish stock indices trading setup is confirmed when the stock indices trading price action moves and closes below the middle band (simple moving average).

Double Tops - Bollinger Bands Indices Trend Reversals Strategy Using Double Top Patterns