How to Draw Indices Trend Lines & Channels on Stock Indices Charts

Sometimes support & resistances are formed diagonally in a similar way like a staircase. This forms a indices trend which is a sustained movement in one direction either upwards or downwards.

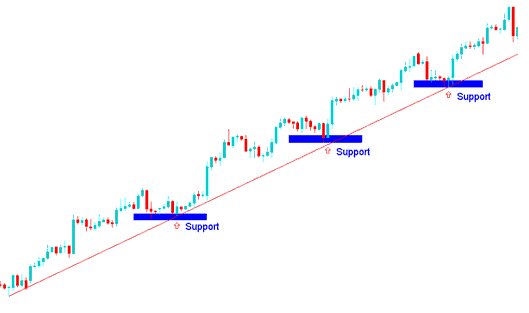

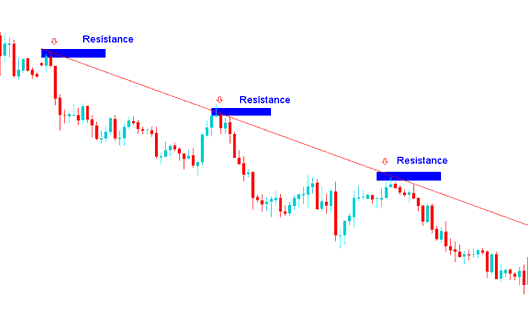

A indices trend line depicts the points of support & resistance for the indices price, depending on the direction of the market. For an upward moving stock indices market indices trend - trend line will shows the points of support and for a downward moving stock indices market indices trend - trend line will show the areas of resistance -indices trend lines are mainly used by many stock indices traders to determine these resistance and support levels on stock indices charts.

A Indices Trend line is a slanting straight line that connects two or more stock indices trading price points and then extends into the future to act as zones of support or resistance. There are two types of indices trend lines: upward indices trend line and downward indices trend line. Indices trading trend line is an aspect of stock indices technical analysis that uses indices line studies to try and predict where the next stock indices price move will head to. A trader must know how to draw and interpret stock indices signals generated by this trend line tool.

The basis of this stock indices technical analysis is based upon the idea that stock indices markets move in trends. Indices trading trend lines are used to show 3 things.

- The general direction of the market - up or down.

- The strength of the current indices trend - and

- Where future support & resistance will be likely located

If indices trend lines forms in a certain direction then the stock indices trading market usually moves in that direction for a period of time until a time when this indices trend line is broken.

Drawing these trendlines on a stock indices chart shows the general indices trend of the stock indices trading market which can either be upwards or downwards.

Shown Below is example of how to draw these trend lines on indices charts

Course: How to Draw Upwards Indices Trend Line & Trade Upwards Indices Trend Move

Course: How to Draw Downwards Indices Trend Line and Trade Downward Indices Trend Move

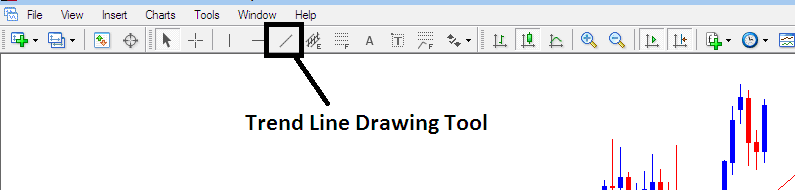

The MT4 software provides indices charting tools for drawing these trend lines on stock indices charts. To draw indices trend lines onto a stock indices chart, stock indices traders can use the indices trading tools provided in MetaTrader 4 software that is displayed below.

To draw indices trendlines on a stock indices chart just click the Stock Indices MT4 Draw Indices Trend Line Tools as shown above on the MT4 platform technical analysis software and select point A where you want to start plotting the trendline & then point B where you want the trend line to touch. You can also right click in trend line & on properties option select option to extend its ray by checking 'ray check box', if you do not want to extend the trend line, then uncheck this option in your MT4 platform. You can also change other indices trend line properties such as color and width on this property popup window of the trend line properties. You can download MT4 software and learn indices trend line technical analysis with it.

The indices trend is your friend. Is a popular saying among investors because you should never go against it. This is most reliable method to trade Indices because once stock indices prices start to move in one direction they can continue to move in that particular direction for quite some time - therefore using this trend method presents opportunity to make profits from the stock indices trading market.

Principles of How to Draw Indices Trend Lines

Use candle charts

- The points used to draw the trendline are along the lows of the stock indices price bars in a rising stock indices market. An upwards bullish indices trend move is defined by higher highs & higher lows.

- The points used to draw the trend line are along the highs of the stock indices price bars in a downwards falling market. A downwards bearish indices trend move is defined by lower highs & lower lows.

- The points used to draw indices trend lines are extremes points - the high or the low indices price. These extremes are important because a close beyond the extreme tells investors the indices trend of the indices trading instrument might be changing. This is an entry or an exit signal.

- The more often a indices trendline is hit but it is not broken, the more powerful its trading signal.

There are two main ways of trading this indices trend line technical analysis set-up:

- The Indices Trend Line Bounce - Indices Trend Line Bounce

- The Indices Trend Line Break - Indices Trend Line Break

Technical Analysis Methods of Indices Trend Lines

The indices trendline bounce is a continuation stock indices signal where stock indices price bounces off this indices trend line to continue moving in the same direction. In a downward indices trend, the stock indices trading market will bounce downward after hitting this indices trend line level which is the resistance level. In an upward indices trend, the stock indices trading market will bounce upwards after hitting this indices trend line level which is the support level.

The indices trend line break is a reversal stock indices signal where the stock indices trading market goes through the trend line & starts moving in the other opposite direction. When a up indices trend is broken then sentiment of the stock indices trading market reverses and becomes bearish and when a down indices trend is broken then the stock indices market sentiment reverses & becomes bullish.

For very strong indices trends, after this indices trend line break signal, the stock indices price will consolidate for some time before heading in the opposite direction. For short term indices trends then this indices trendline break stock indices signal will mean stock indices price may reverse immediately.

In indices trading, both the trend line bounce and the trendline break that are used in technical analysis charts are based upon these trend line levels being support & resistance areas.

Entry, Exit and Setting stops:

This indices trend line trading method is used to determine good entry and exit points, protective stops are placed just above or below these trend lines. The indices trend line bounce is a low-risk entry method used by stock indices traders to place entry trades after stock indices price has retraced. Indices trades are setup along these trend line levels and a stop loss placed just above or below these trend lines.

The indices trendline break is a crucial technical indicator of possible indices trend reversal. When the trend line is broken the stock indices price starts move in the opposite direction. This provides an early exit signal for stock indices traders to exit their open trades and take profits. When there a penetration of these trend line levels, it is a signal that the stock indices price can begin heading in the opposite direction.

Unlike other stock indices technical analysis indicators there is no formula used to calculate the trend line, this indices trend line formation is just plotted between two chart points on the stock indices chart.