FTSE 100 Stock Index

FTSE - Financial Times Stock Exchange, FTSE 100 represents the Stock index of top 100 largest companies in the UK that are listed in the London Stock Exchange Market. The calculation of this stock index incorporates stocks which are determined quarterly. These stocks included in the FTSE 100 represent 80 % of total market value of London Stock Exchange listed companies.

Because the FTSE 100 index tracks 100 companies the index will be more volatile as compared to an index such as the Germany DAX 30 which only tracks 30 companies.

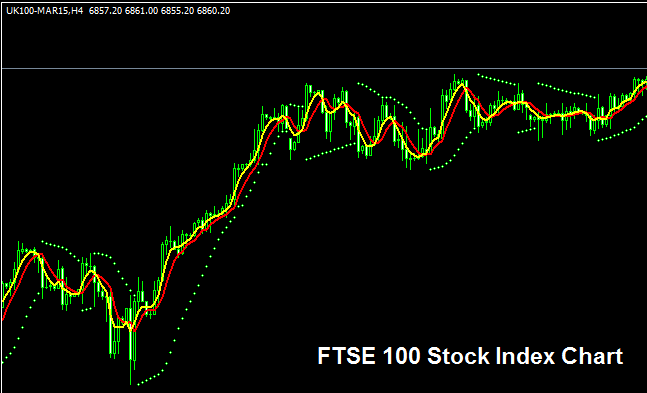

The FTSE 100 Trade Chart

The FTSE 100 trade chart is displayed and illustrated above. On the example above the index is named as UK100CASH. As a trader you want to find an online broker that provides this FTSE 100 trade chart so that you can start to trade it. The example above is of FTSE 100 on the MT4 Forex & Stock Indices Trading Software.

Other Trading Information about the FTSE 100 Index

Official Symbol - UKX:IND

The 100 components stocks that makes up FTSE 100 are picked from the top UK companies. The FTSE 100 share index is closely followed as an indicator of the prosperity of UK businesses. The constituents that make up this stock index are revised quarterly. The calculation of this stock index is a simple formula based on market capitalization.

Strategy for Trading the FTSE 100 Stock Index

FTSE 100 shows the relative movement of top 100 stocks in the UK. In general the share value of top 100 companies will keep heading upward, therefore this index will also over time keep heading upward. Should a company not meet the required growth targets, company will be removed from the index & replaced with another company that has better growth prospects.

As a trader wanting to trade this stock index, general stock index market direction at any given time will be more bullish than bearish. This is because as long as the 100 companies being tracked are doing good business, then their share value will keep going up, & therefore this index will also keep heading in an upward trend.

As a trader you want to be biased and keep buying as the stock index moves up. When the UK economy is doing well (most times it's doing well) this upward trend is more likely to be ruling. A good trading strategy would be to buy dips.

During Economic SlowDown and Recession

During economic slowdown and recession times, companies start to report lower profits and lower growth prospect. It is due to this reason that traders start to sell stocks of companies reporting lower profits and therefore the stock index tracking these particular stocks will also begin to move downwards.

Therefore, during these times stock index trends are likely to be heading downward and as a trader you should also adjust your strategy accordingly to suit the prevailing downwards trends of the stock market index that you are trading.

Contracts & Specifications

Margin Required Per 1 Lot - £ 70

Value per 1 Pips - £ 0.1

NB: Even though the general trend is generally upward, as a trader you have to factor in the daily market volatility, on some days the stock index might oscillate or even retrace, stock index market retracement might also be significant at times and therefore as a trader you need to time your entry precisely using this trading strategy: Stock index trading strategy & at same time use proper money management rules just in case of more unexpected volatility in the market trend. About money management rules in index trading topics: What is stock index money management & stock index money management methods.