Nikkei 225 Index

Nikkei 225 is a stock market index for the Tokyo Stock Exchange in Japan. This stock index tracks stocks of the top 225 companies shown in Tokyo Stock Exchange.

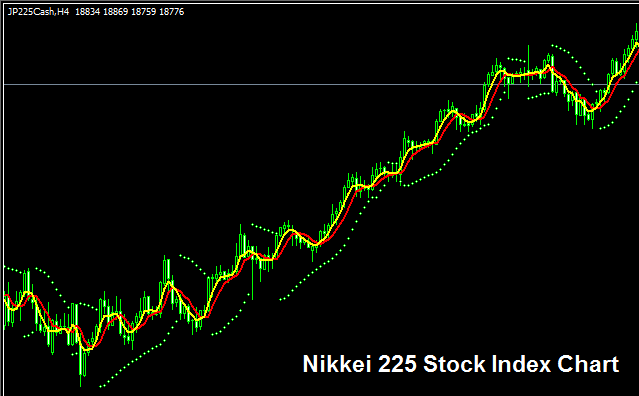

The NIKKEI 225 Trade Chart

The NIKKEI 225 trade chart is displayed & illustrated and shown above. On the example above the index is named as JP225CASH. As a trader you want to find an online broker that provides NIKKEI 225 trade chart so that you can begin to trade it. The example above is of NIKKEI 225 on MT4 Forex & Indices Trading Platform.

Other Information about NIKKEI 225 Stock Index

Official Symbol - NKY:IND

The 225 components stocks that make up the NIKKEI 225 are selected from the top Japanese companies. The NIKKEI 225 share index is closely followed as an indicator of the prosperity of Japanese businesses. The calculation of this index is a simple formula based on market capitalization.

-

The NIKKEI 225 shows relative movement of the top 225 stocks in Japan. Because this stock index tracks 225 companies it will be more volatile when compared to an index like Germany DAX 30 that only tracks 30 companies.

As a trader wanting to trade this index, this index is generally more volatile & the market trend for this index although generally upward over a long time it will have more oscillations than other stock index. Your trading strategy should factor in more volatility when trading this index.

When the Japanese economy is doing well (most times it is doing well) this upwards trend is more likely to be ruling. A good stock index trade strategy would be to buy dips.

During Economic Slow-Down & Recession

During economic slow-down & recession times, companies begin to report lower profits & lower business growth prospects. It is because to this reason that investors begin to sell stocks of companies reporting lower profits & therefore index tracking these particular stocks will also start to move downward.

Therefore, during these times index trends are likely to be moving downwards & as a trader you should also adjust your trading strategy accordingly to fit the prevailing downward trends of the stock market index that you're trading.

Contracts & Specifications

Margin Requirement Per 1 Lot - JPY 90

Value per 1 Pips - JPY 0.1

NB: Even though general trend is generally upward, as a trader you've to factor in daily market volatility, on some days the index might oscillate or even retrace, index market retracement may also be significant at times & therefore as a trader you need to time your entry precisely using this trade strategy: Indices trade strategy & at the same time use proper money management rules just in case of more unexpected volatility in the market trend. About money management rules in stock index trading topics: What is index money management and index money management methods.