Chart Time Frames for Trading Stock Indices

When it comes to trading index you will have to decide which trade chart time frame is best for your strategy. This will depend on what type of trader you are and what your profit objective is.

There are 4 types of trading styles and the style of trading that you choose is what will determine what chart time frame you'll use when trading.

The 4 styles of trading are:

1. Scalping

2. Day trading

3. Swing trading

4. Position trading

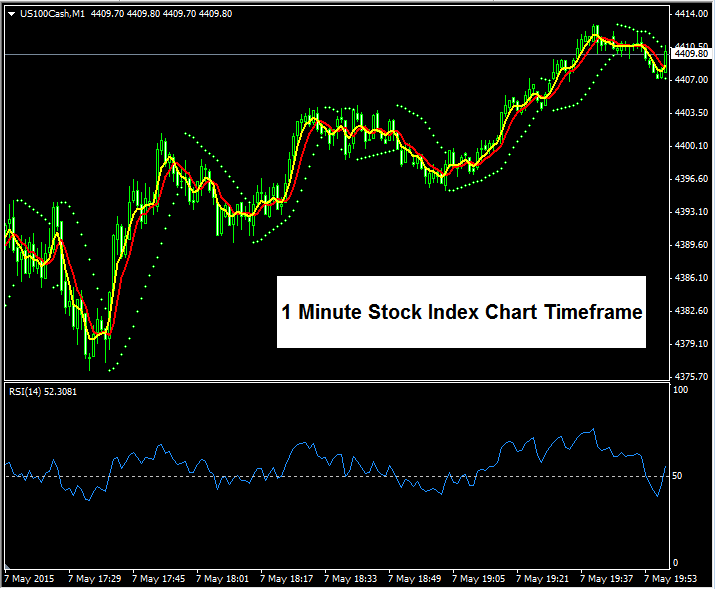

Scalping

Scalping is a trading method where a traders trades big lots and aims to profit from small market movements. The scalper then opens and closes trades quickly - typical trades last from a few seconds to a few minutes usually less than 10 or less than 5 minutes for some. For example a scalper may trade lot sizes of 50 lots and aim for take profits of 10 to 20 points. Because in stock index there is the fractional points or fractional pips 10 points will become 100 points because the last added point denotes a fraction.

This typical trade will be kept open for only a short while and the stops used are very tight, a scalper will only set their stops at about 5 or 6 or 7 pips, this means that most of the time scalpers trade fast moving markets so that when they open a trade it's more likely to go in their favor very quickly & hit their take profit. Scalpers don't keep their trades open for very long & they use the 1 minute chart time frames so as to capture the quick market moves. Scalpers will also make many trades per day usually 30 to 50 trades per day. This method of trading requires those traders that can make decisions very quickly.

1 Minute Index Trade Chart Time frame for Trading

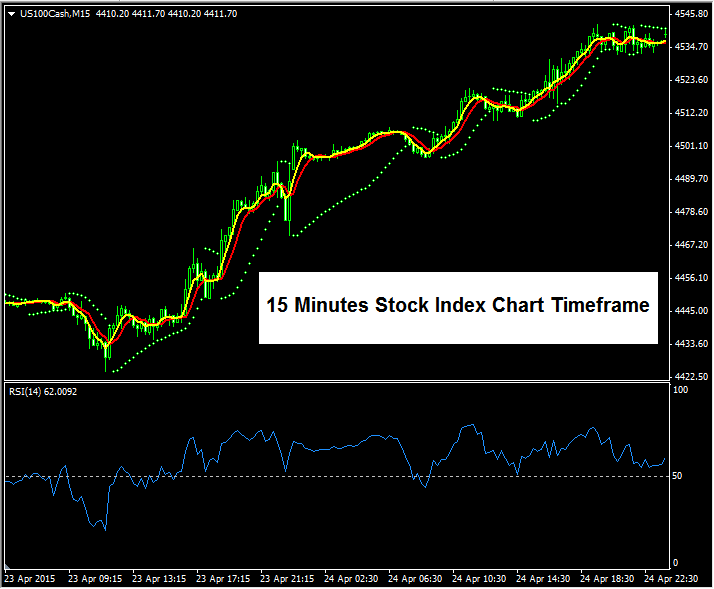

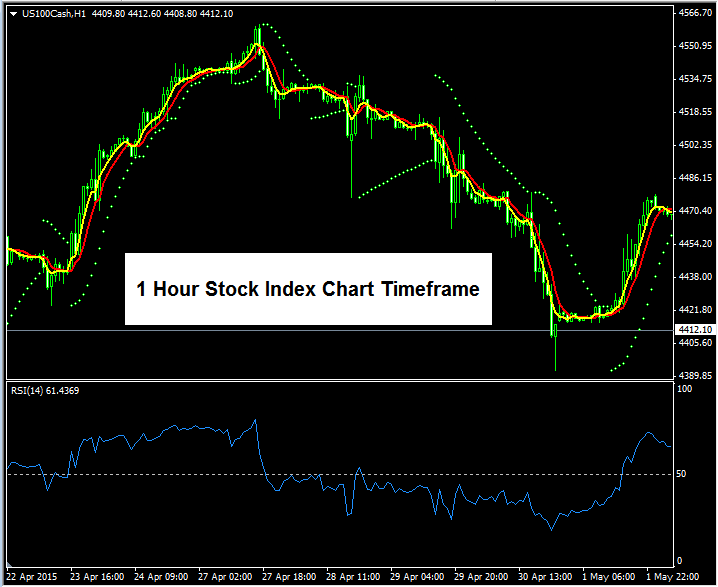

Day Trading

Day trading is the most popular trading method among all other trading methods, maybe scalpers may disagree but day trading is the most popular. In day trading the traders will open trades with modest amount of lots and they aim to take profits from the intra-day trends which may move an average of 40 to 70 points. The day traders will open about 2 or 3 or 5 lots per trade and will set take profit targets of about 30 points up to 50 points. Day traders will aim for this number of pips every day & will only open 1 or 2 or 3 trades per day & not more. Day traders will also close all their trades at the end of the day even if their profit targets have not been reached; they close all their trades and wait to open others the following day. This is why this group of traders are called day traders - they only trade during the day & close all their trades at the end of the day.

Day Traders use intra-day charts such as 15 minutes, or 1 hour chart depending on the time they spend on trading & also depending on which chart generates the best trading signals based on their trading system. If you want to become a day trader you will have to practice with both of these trading chart time frames so as to decide which chart time frame is best for you. Some day traders are faster than other & these ones prefer the 15 minute chart time frame, others are slower & prefer the 1 hour chart time frame.

15 Minute Index Trade Chart Time frame - Day Trading

1 Hour Stock Index Trade Chart Timeframe - Day Trading

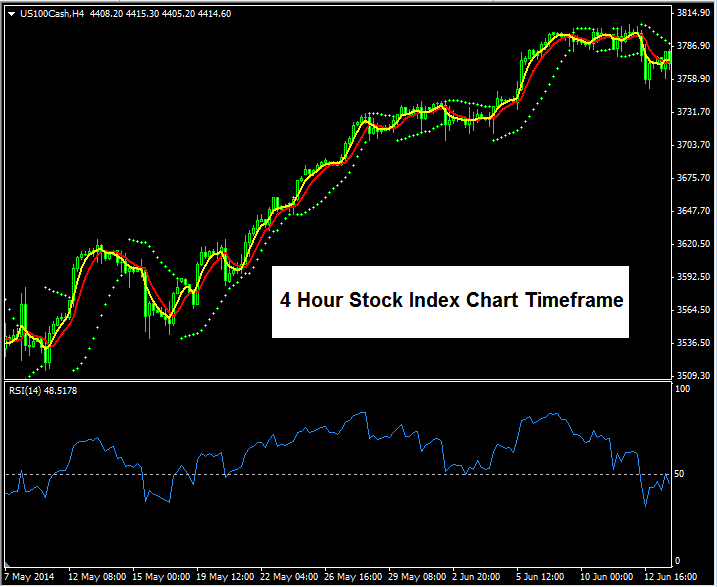

Swing Trading

Swing trading method is where trades open and hold trades for a few days so as to let their trades catch extra momentum and extra pips in profit. Swing traders will leave their trades open overnight - & unless you know what you are doing as a beginner please leave these method to those who know what they are doing, leaving your trades open overnight is never a good idea as you're taking too much risk as the market may reverse on your trades. Swing traders will use the 4 hour charts so as to determine the medium market trend and open trades that will be in the direction of this medium term trend. These trades will last from 3 to 5 days. Swing traders will open lot sizes of 1 or 2 or 3 lots and their trade will stay open for a few days. Day traders will only open 1 or 2 or 3 trades per week and will spend most of their time monitoring their open trades rather than placing trades.

For this method the trader is ready for wide market swings, therefore the name swing trading.

4 Hour Stock Index Trade Chart Time frame - Swing Trading

Position Trading

Position trading is the least popular method of all in trading, position trading is more of an investing strategy rather than trading - this method uses the daily & weekly trade chart time frames to catch long term trends and the position trader then opens trades and keep these trades open for months or even years so as to catch the momentum of the long term trend. This method is also prone to wide market swings and sometimes the market may retrace all the profits made by a trader & that's why this method is the least popular method when it comes to trading, hardly any trader trades using this method.

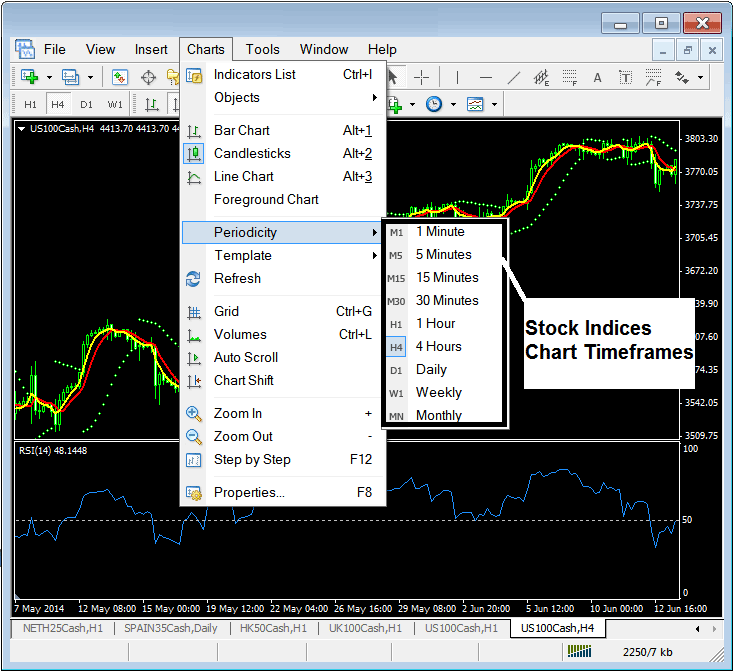

Where to Find Chart Time Frames on the Stock Indices Trading Platform

To set your chart time frame you'll use the 'Charts' menu next to file, view & select the option marked "Periodicity" as is shown below.

From the above periodicity menu a trader can change the chart time frame to any chart time frame that they would like to trade. The current set time frame is always highlighted, for example the above chart is the 4 hour chart - on the periodicity menu the 4H next to the 4 hour chart is highlighted.