Leverage & Margin in Indices Trading

The main reason why online stock index trading is popular is because of leverage. Unlike traditional markets where a trader uses only their capital to trade with, in online index market traders can borrow extra money from their broker and use this extra money together with their own money so that to have more capital to trade with.

For example if a trader has $10,000 dollars in capital in the online index market a trader can also borrow extra money when opening trades & open transaction of bigger value than his $10,000 dollars capital using leverage.

A trader can use leverage of 100:1 which is the default leverage in the online index market. For leverage 100:1 what this means is that a trader can borrow $100 dollars for every $1 dollar that they have in their account. Therefore to calculate the total amount that a trader will borrow using leverage 100:1 then a trader will multiply his invested capital by 100 times, therefore if a trader invests $10,000 dollars multiplied by 100 times, then the total amount that a trader can now trade with is a total of $1,000,000. This is what makes the online indices market popular - Leverage.

Now that a trader will be trading on borrowed capital & as with every borrowed capital there is always a security that one must put down before accessing borrowed capital, what is the security for this leveraged amount?

The security for this leveraged amount is the capital that you open an account with - in this case $10,000 dollars. This $10,000 dollars is known as margin - margin is the security for the leverage that you'll be using. Therefore, in order to continue accessing the leverage or the borrowed capital you must make sure that you do not lose your capital so that as to maintain this leveraged amount.

This is why as a trader you must do everything when it comes to learning about index trading so that you can continue making profit on the index market and that way your account balance continues increasing and that way you continue having access to the leveraged amount.

How Do I Properly Trade with Leverage & Margin?

As a trader you need to know that just because you have been given 100:1 leverage you do not have to use all of it. If you want to trade this market for long you need to keep your used leverage to below 10:1. That way you do not blow your account in just a few trades, if you want to follow even better money management you can even reduce your used leverage to a maximum of 5:1 - especially if your capital is $20,000 or $50,000 or $100,000. The more capital you have the less leverage you need to use so that as to better manage your capital so that you trade longer.

The Difference between Maximum Leverage & Used Leverage

When your broker gives you leverage 100:1 this is known as maximum leverage, because it is the maximum set leverage for your account, but you do not have to use all of this leverage you only need to use about 10:1 or 5:1 leverage, this 10:1 or 5:1 leverage that you'll be using is known as Used Leverage.

Money Management and the Best Leverage to Use

It is best to keep your leverage use below 10:1 leverage so that as to better manage your money. It is best to keep your leverage low & this way you will have enough Free Margin as compared your used margin.

As long as you keep your leverage below 10:1 you will have enough free margin & you will be able to follow good money management rules.

If you use a lot of leverage you will be over-leveraging and you will not be following the best money management rules & you will be taking greater risk with your invested capital.

To keep your risk to a minimum do not over leverage & always keep your used leverage below 10:1 or even below 5:1.

Example of Leverage & Margin

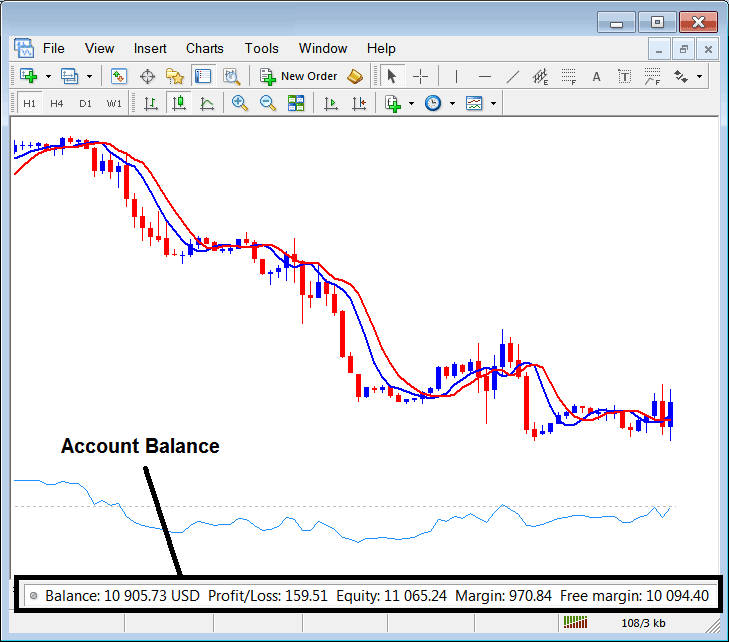

For leverage & margin trading let us show you an example of this leverage & margin & where these 2 can be found on the stock index trading platform.

Leverage & Margin Trading

On the above account the account balance is shown - $10,905

The Profit is $159

The equity is $11,065

The Margin is $970 - This is the margin used for the trades that are currently open

Free Margin is $10,094

The margin used is $970 which is about 8% of the equity, equity is 11,000 - This means the leverage use is 8:1.

The free margin is $10,094 which is about 10 times the used margin, free margin that is not being used is a lot meaning for this account the good money management rules are being followed & the correct leverage, that is below 10:1 is being used.

As a trader you should am to keep all your trades close to these levels so that you're in a position to better manage your account and ensure you are not using too much leverage - over leveraging.

This way you can make good profit in your account while at the same time not risking too much of your capital.

How Leverage is Used in Indices Transactions?

If you take an example of three index in the online market that are shown below:

1. Australia ASX 200 - AUS200Cash

Margin per Lot - AUD 70

The margin or required capital by a trader to open AUS200Cash index is AUD 70, this is after leverage, if there was no leverage a trader would be required to put AUD 7000 as the capital.

2. Italy FTSE MIB 40 - IT40Cash

Margin per Lot - € 250

The margin or required capital by a trader to open IT40Cash index is € 250, this is after leverage, if there was no leverage a trader would be required to put € 25,000 as the capital.

3. Spain IBEX 35 - SPAIN35Cash

Margin per Lot - € 140

The margin or required capital by a trader to open SPAIN35Cash index is € 140, this is after leverage, if there was no leverage a trader would be required to put € 14,000 as the capital.

From the above example you can see that leverage makes the online index market available to most people by reducing the initial capital required by over 100 times using leverage option 100:1, this is the reason why stock index trading is becoming popular.